I’ve been digging through some statistics for my own benefit.

When you read or hear a statistic that country X is generating Y% of electricity via renewables it can sound wonderful, but the headline number can conceal or overstate useful progress. A few tips for readers new to the subject:

- Energy is not electricity. So you need to know – were they quoting energy or electricity. For most developed nations, electricity accounts for something around 40% of total energy.

- “Renewables” includes two components that are important to separate out:

- hydroelectric – this is “tapped out” in most developed countries. If the “share of renewables” is say 30%, but hydro is 20% (i.e. 2/3 of the total renewables) then the expandable renewables are only 10%. This can help you see recent progress and extrapolate to possible future progress (different story in developing countries, but there is often a large human cost to creating hydroelectric projects)

- biomass – if you stop burning coal and you burn wood chip instead this tips the reporting scales from “the work of Satan” to “green and renewable”, even though burning wood chip generates more CO2 emissions per unit of electricity generated. Not all biomass is like this, but as a rule of thumb, put the biomass entry into the “more investigation needed” pile before declaring victory

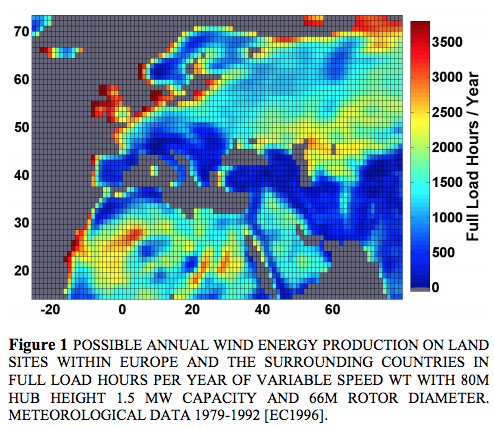

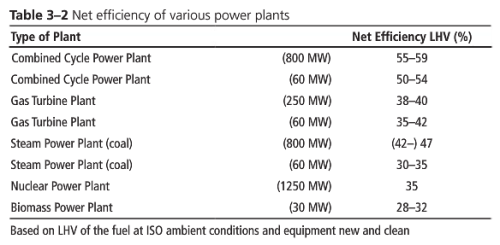

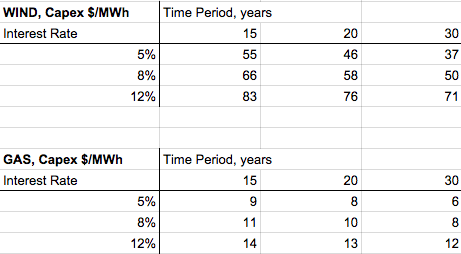

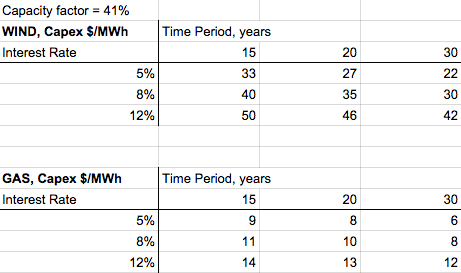

- Nameplate is not actual – if you have a gas plant (designed to run all the time) the actual output will be about 90% or more of the nameplate (the maximum output under normal conditions), but if you have a wind farm the actual output across a year will be about 20% of the nameplate in Germany, 30% in Ireland and over 40% in Oklahoma. So if you read that “10GW of wind power” was added to Germany’s generating capacity you need to mentally convert that to about 2GW. Similar story for solar – there is a conversion factor.

If you mentally take account of these points when you hear an update, you will be with the 1% of journalists who could pass the literacy test on the progress of renewables. It’s an elite club.

Once again I’ll state that I’m not trying to knock renewables, I’m trying to promote “literacy”. Instead of hapless cheerleaders, think informed citizens..

So, onto recent data.

I’m using two stalwarts of energy reporting: IEA and BP.

IEA produce data to 2015 and quote useful units like electricity consumed in TWh. This is a unit of energy – a TWh is a billion kWh. You find kWh on your electricity bill.

BP produce data to 2016 – which is better – and breakdown renewables much better, but quote units of Mtoe – millions tons of oil equivalent. If you delve into energy industry reports, you often find mixed together in one report: kWh/TWh (energy), GJ (energy), GW (power), tcf (volume of gas), barrels of oil, mmBtu (energy in obscure British units)..

In the case of the BP report it’s not clear to me how to convert from Mtoe to GWh – they do provide a footnote but when I do the conversion I can’t reconcile the numbers using their footnote. No doubt one of our readers has gone down this rabbit hole and can illuminate us all (?). In the meantime, I took the BP numbers in Mtoe and looked up IEA % values for 2016 in TWh and worked out a conversion factor – multiply Mtoe by 0.0045. Then cross-checked with Fraunhofer ISE for Germany. This allows us to see the BP 2016 renewables breakdown in real electricity units rather than in mythical barrels of oil.

Another note – I’m not trying to generate exact figures. Every source has different values. Reconciling them is a big undertaking and very uninteresting work. I’m simply trying to get some perspective on actual renewables progress.

I don’t quote nuclear energy statistics in this article. It’s very low carbon emission, but not exactly “renewable”. The real reason for not including the numbers is that most developed countries are not significantly expanding their nuclear generation, and in Germany’s case are shutting it down. China is a different story, with a big nuclear expansion ongoing.

Germany v US

You would think that Germany, one of the leading lights in renewable energy, would be greatly outperforming the US on CO2 emissions reduction.

- 2005 – 2015 German CO2 reduction = 0.9% p.a

- 2005 – 2015 US CO2 reduction = 1.1% p.a

Over that time period the German population has stayed the same, while the US population has grown by about 9%, so we can adjust the US reduction to about 2% p.a on a per capita basis.

Now the US emissions peaked in 2005. You actually don’t need to read a report to find that out because when the US commitment to reducing CO2 emissions was announced in Paris in 2015 the commitment was a reduction “from 2005”. Being cynical about politicians never loses, and sure enough (when checking data in a report) the peak was 2005 – and the reduction from 2005 to 2015 was already about 12%.

Germany’s emission peaked in 1990 so I believe their commitment is always referenced to 1990. The story I haven’t verified is that after the collapse of the Soviet Union and the re-unification of Germany, lots of dirty heavy industry shut down and this was a big help in emissions reductions.

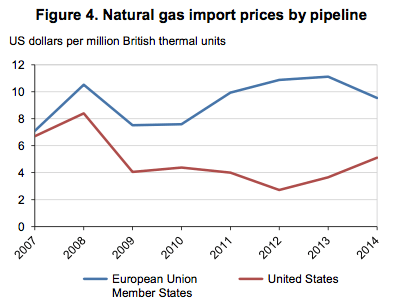

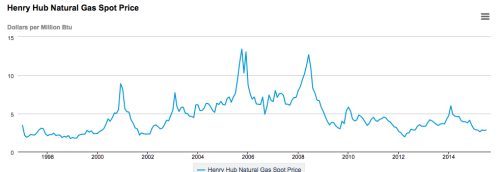

The US reduction looks to be – in part – due to the embrace of natural gas due to its recent very low cost (gas produces about half the CO2 of coal for the same electricity production). This is a result of the current revolution in “unconventional gas”.

When we look at CO2 emissions per kWh in 2016 the story is also surprising:

- Germany – 1.3g CO2/kWh

- US – 1.2g CO2/kWh

So this tells us that the GHG efficiency of electricity generation is effectively the same in both countries, slightly better in the US.

When we look at total usage (across all electricity generation, including industry) the story is what we might expect:

- Germany – 19 kWh per person per day

- US – 35 kWh per person per day

This tells us that the US uses almost double the electricity per person.

Changes in Renewables

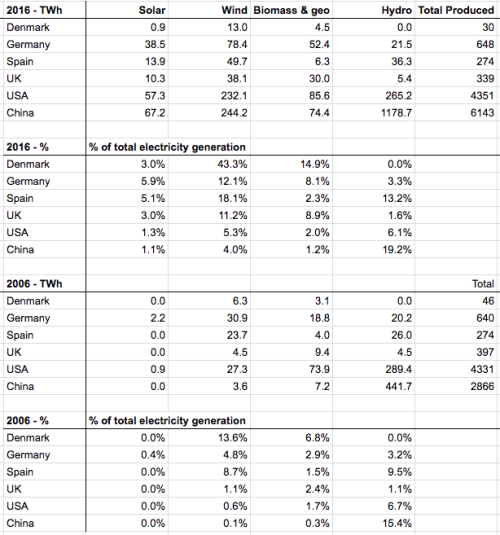

I looked up a few other countries – Denmark, the UK and Spain because they have a big push into renewables; and China to contrast a rapidly developing country. The last column in the table, Total Produced, is total electricity produced from all sources, including fossil fuels and nuclear.

The IEA values (not shown) give lower total electricity for each country. The BP figures are electricity produced and IEA figures are electricity consumed. The solar + wind value for Germany in 2016 moves from 18% to 20% of total if I use the lower IEA total.

I also looked up electricity prices in the IEA report and while I have values for 2016, I don’t have comparable values for 2006. I couldn’t find the 2006 or 2007 version of the report. Based on a variety of websites all using different methods, quoting in different currencies and from unverified sources (so not reliable) the average consumer price in Germany has gone from about 19c/kWh to 33c/kWh from 2006-2016 (US$). The US looks almost flat, perhaps from 12 to 12.5c/kWh. UK from 14 to 21c/kWh. The IEA report didn’t give a figure for Denmark.

So Germany produces about 18% of electricity from solar + wind. Its total renewables are 30% if we include biomass, and about 21% if don’t include them. As I mentioned at the start, biomass sometimes includes burning “renewable” wood chip instead of fossil fuels. Biomass is a (big) subject for another day with numerous problems and I haven’t looked at the breakdown.

The Denmark figure for total electricity is probably quite misleading – see the huge reduction in electricity production from 46 TWh to 30 TWh over 10 years. On wikipedia someone has provided a better breakdown, showing consumption as well and the consumption has dropped by just 4% over that time. Also 2006 appears to be a big outlier in electricity production. Denmark is a country connected to neighboring grids and generating lots of wind energy. So Denmark’s 2006 real figure for wind was about 20% of total consumed (not 14%) and has gone up to 43% over 10 years. On this basis Denmark could be at 80% of electricity generation by wind in 2035.

Confusion

When looking for electricity price changes, here was a random site I came across, Economists at Large:

By June 16 this year electricity generated from solar and wind power accounted for a record 61% of total electricity generated in Germany.

The actual figure for 2016 is about 18%.

If I went looking I’m sure I could find lots of sites, including “reputable” media outlets, with wide ranges of inflated figures. It’s very easy to generate confusion – quote a peak daytime value like this “Germany’s renewable output was …%… on May 28th at 1:15pm” and wait for the recyclers of mush (this includes “reputable” media outlets) to propogate it in a new way. Or quote growth figures – as in how much has been added this year. Or quote capacity added, and rely on the fact that no one understands that 10GW of wind farm only generates about 2GW on average of output in Germany. And so on.

I realize young people may expect media outlets to “fact check” but that is not their job. Their job is to generate headlines and have their stories quoted more widely.

Also, if you pay zero for your electricity because you have solar power you might think that you are generating all of your own electricity. Most of the time you would be wrong. Various governments have guaranteed feed-in tariffs for rooftop solar at well above market price.

Basic energy literacy means understanding the difference between these items.

Conclusion

I was just trying to find the core statistics for my own understanding and was especially interested in Germany.

For Germany, we could look at the 3.5x increase in solar + wind in a decade and say “amazing”. Alternatively, we could look at going from 5% to 18% of total electricity generation in 10 years and say that to get to 80% of electricity production will take another 40-50 years at the same rate and say “disappointing”.

Remember that electricity is only about 40% of energy use in most developed countries. Therefore, if you want to decarbonize the whole economy you also have to boost your electricity supply by 2.5x and switch over heating, transport, etc to electric supply.

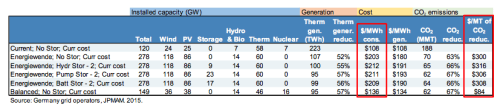

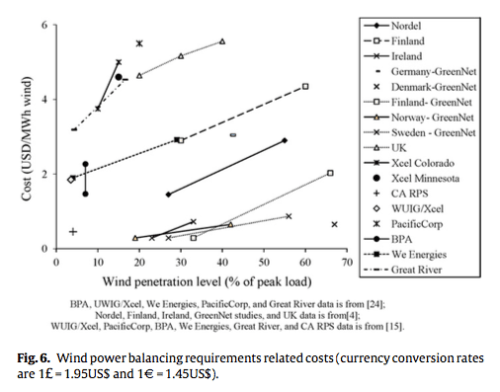

At the moment, there are currently issues with increasing “non-synchronous” generation beyond a certain point (see V – Grid Stability As Wind Power Penetration Increases). If you read spruiking websites you will find two common suggestions, first “people said we couldn’t get past 10% and now we’re already at 20%” and second “look at Denmark”. If you like happy stories probably skip the rest of this section..

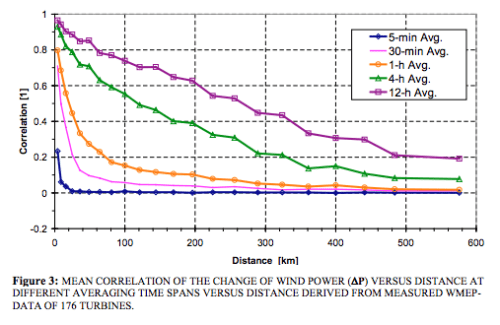

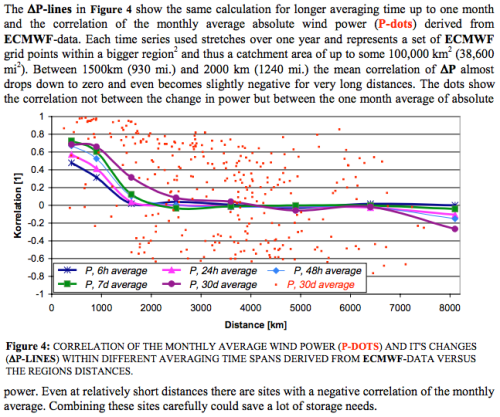

The most helpful textbook I found on the topic was Renewable Electricity and the Grid : The Challenge of Variability written by people who are trying to do it. Long story short, integrating wind energy is very easy at the start, and up to about 20% of total supply on average it doesn’t seem to present a problem. Above 20% there are questions and uncertainties. These are electricity generation and grid experts contributing to the various chapters.

The key point is that grid stability can come from who you are connected to and how.

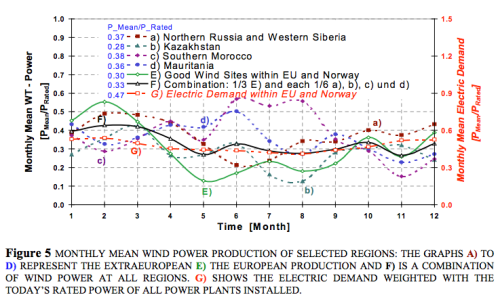

Denmark, while a country, is really just the size of a large city (population 6M) connected to the rest of Europe and this connection provides their grid stability. Denmark produced 43% of their electricity from wind in 2016 but this is a much lower % of the grid that it is connected to. The question is not “can one small country connected to nearby large countries produce 80% of electricity from wind?” but instead “can the interconnected grid produce 80% from wind?” The answer to the first question is of course yes. The other countries provide grid stability to Denmark. When all the surrounding countries are producing wind energy at 80% of the total inter-connected grid it will be a different story.

However, this is not some fundamental physics problem, it’s an engineering problem that I’m sure can be solved. I haven’t dug in much beyond the references in Part V (referenced above) so I don’t know what issues and costs are involved.

Other Articles in this Series

Renewable Energy I – Introduction

Renewables II – Solar and Free Lunches – Solar power

Renewables III – US Grid Operators’ Opinions – The grid operators’ concerns

Renewables IV – Wind, Forecast Horizon & Backups – Some more detail about wind power – what do we do when the wind goes on vacation

Renewables V – Grid Stability As Wind Power Penetration Increases

Renewables VI – Report says.. 100% Renewables by 2030 or 2050

Renewables VII – Feasibility and Reality – Geothermal example

Renewables VIII – Transmission Costs And Outsourcing Renewable Generation

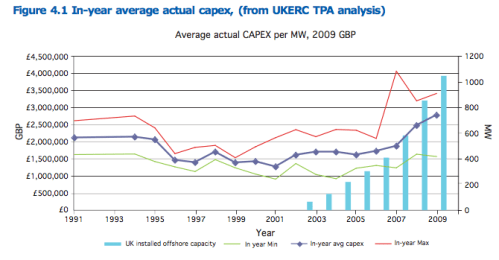

Renewables IX – Onshore Wind Costs

Renewables X – Nationalism vs Inter-Nationalism

Renewables XI – Cost of Gas Plants vs Wind Farms

Renewables XII – Windpower as Baseload and SuperGrids

Renewables XIII – One of Wind’s Hidden Costs

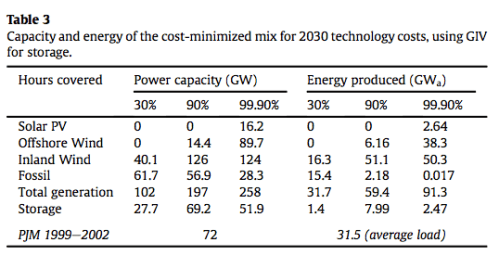

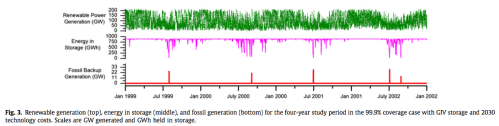

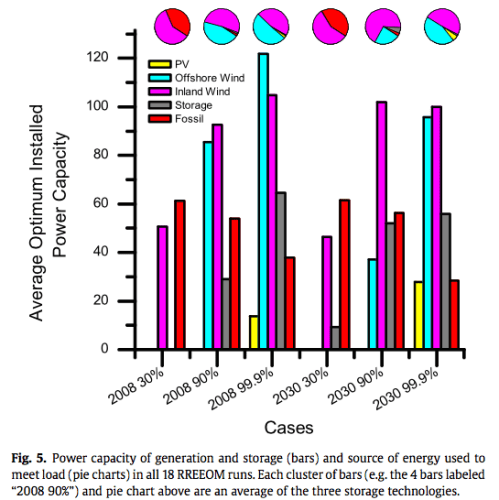

Renewables XIV – Minimized Cost of 99.9% Renewable Study

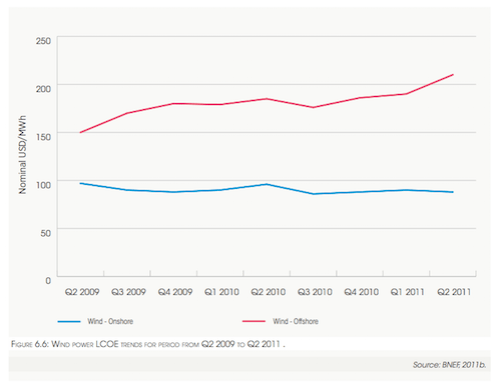

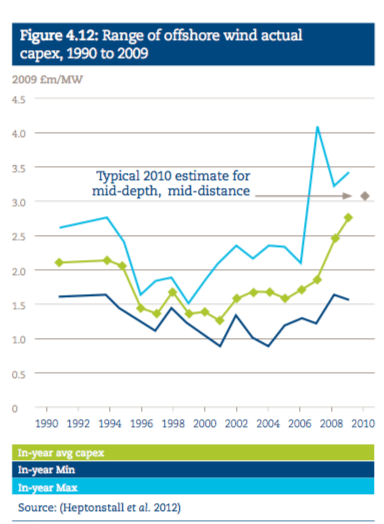

Renewables XV – Offshore Wind Costs

Renewables XVI – JP Morgan advises

Renewables XVII – Demand Management 1

Renewables XVIII – Demand Management & Levelized Cost

Renewables XIX – Behind the Executive Summary and Reality vs Dreams

References

BP Statistical Review of World Energy June 2017

BP Statistical Review of World Energy June 2017 – Renewables Appendices (this is a separate pdf)

IEA Key world energy statistics 2017

Renewable Electricity and the Grid : The Challenge of Variability, Godfrey Boyle, Earthscan (2007)