In Renewables VI – Report says.. 100% Renewables by 2030 or 2050 we looked at a feasibility study for 100% renewables in Australia by 2030 and 2050. Many people see feasibility studies and say “look, it’s achievable and not expensive, what are we waiting for? Giddy up“. In fact, it was such an optimistic comment that led me to that report and to study it.

Feasibility studies are the first part of a journey into the unknown. Most things that look like they are possible usually are. But it might take 30 years longer and $100BN more than expected, even if we get there “in the end”. So feasibility studies attempt to get their hands around the scope of the task.

In my comment at the conclusion of the last article, after stating my point of view that getting to 100% renewables by 2030 was not at all realistic, I said:

Readers enthusiastic about renewable energy and frustrated by the slow pace of government action might think I am being unnecessarily pessimistic. Exactly the kind of attitude that the world cannot afford! Surely, there are upsides! Unfortunately, the world of large complex projects is a world that suggests caution. How many large complex projects finish early and cost only 80% of original budget? How many finish years late and cost 3x the original budget? How many apparently simple projects finish years late and cost 3x the original budget?

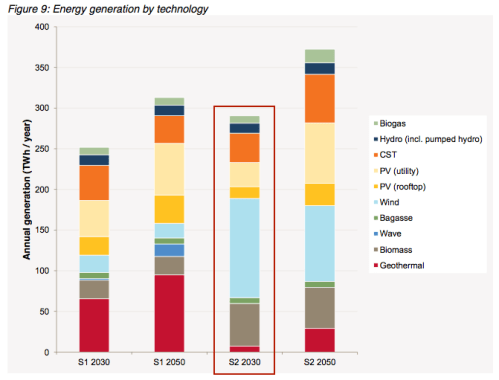

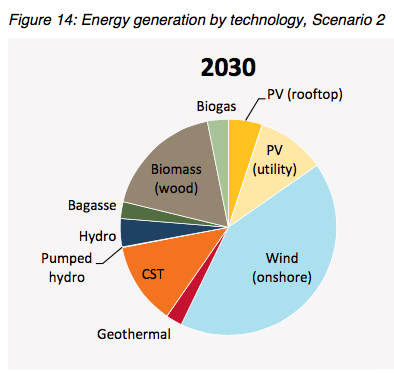

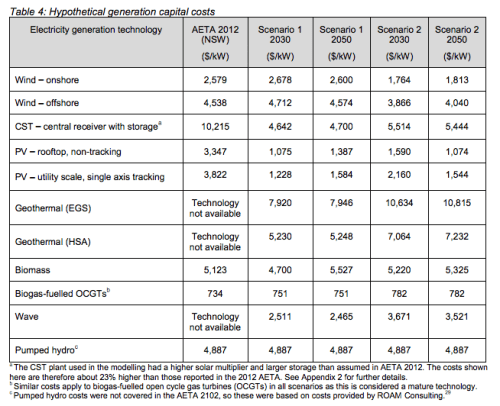

One of the questions that came up in the discussion was about geothermal – the report had an “optimistic on technology” 2030 scenario with 9 GW of supply, and the “optimistic” 2050 scenario with 13 GW of supply. We mainly focused in the report on the “non-optimistic” version which had no major technical breakthroughs and therefore little geothermal. I actually started digging into the detail because details are where the real stories are and also to understand why any geothermal was showing up in the “non-optimistic” 2030 scenario.

The Australian geothermal energy story turns out to be a salutary tale about feasibility and reality. So far. Of course, tomorrow is another day.

I would hate for readers to think I don’t believe in progress, in trying to break new ground, in new technologies. Far from it.

Most breakthroughs that have changed the world have started as ideas that didn’t really work, then half-worked, then inventors battled away for years or decades stubbornly refusing to “face reality” until finally they produced their “new steam engine”, their “wireless communication that spans countries”, their “affordable personal computer” and so on. The world we live in today is a product of these amazing people because inventions and technical progress change the world so much more than politicians.

All I am attempting to do with this series is separate fact from fiction, current technology from future technology and “feasible” from “accessible”. Many people want to change the world, to replace all of the conventional GHG-producing power with completely renewable power. Is it possible? What are the technical challenges? What will it really cost? These are the questions that this series tries to address.

And so, onto Lessons in Feasibility.

Here is a press release (originating from Geodynamics but on another website) in 2009:

An Australian geothermal energy company is at the forefront of one of the most important and exciting resource industries in the world and is preparing for a landmark year in 2009. Kate Pemberton reports.

By mid-2009, Brisbane-based Geodynamics expects to be providing Australia’s first hot rocks geothermal-generated electricity.

Following the successful completion of the Proof of Concept stage, the company’s joint venture operations with Origin Energy in the outback town of Innamincka, South Australia, will progress to commercial demonstration.

Geodynamics Managing Director and CEO Gerry Grove-White said Innamincka, which has a permanent population of just twelve, is set to be the proving ground for hot fractured rock (HFR) geothermal energy when it swaps diesel fuel power for geothermal power.

“From that one small step, Geodynamics aims to make the great leap into making the Cooper Basin a major new energy province for Australia,” said Mr Grove-White..

..Geodynamics said that the development of Australia’s vast geothermal resources could provide more than 25 per cent of the nation’s increase in demand for energy by 2050. The company believes Australia’s geothermal resources offer the most realistic and timely solution for the demand for clean, zero emission, base load power. In the coming year, Geodynamics will be seeking a significant proportion of the $500 [?] Renewable Energy Fund promised by the Federal Government to help finance its own commercial geothermal power demonstration plant.

I think the Renewable Energy Fund had $500M. On its own $500 wouldn’t get you far (just being realistic here), and another press release has:

Geodynamics also said it had submitted an application for $90 million of funding under the Federal Government’s Renewable Energy Demonstration Program (REDP).

The original press release went on:

Geodynamics’ Cooper Basin site is regarded as one of the hottest spots on earth outside volcanic centres. To date, the company has drilled three wells – Habanero 1 (named after the world’s hottest chilli), Habanero 2 and Habanero 3. Of these, Habanero 1 and 2 are not of commercial scale. Habanero 3, the first well to be drilled using the ‘Lightning Rig’, is the first commercially viable well to be drilled and its target depth of 4,221 metres was reached on 22 January 2008. The completion of drilling in Habanero 3 is the largest well of this depth ever drilled onshore in Australia and the first commercial scale HFR production well to be drilled. Geodynamics’ tenements – GELs 97, 98 and 99 – have been shown to contain more than 400,000 petajoules (PJ) of high-grade thermal energy. The company’s confidence is based on the fact that:

- The size of the resource is clear – the large bodies of granite have been clearly delineated and proven to exist through drilling.

- The quality and potential of the resource is proven – temperatures have been measured up to 250°C.

- The world’s largest enhanced underground heat exchanger has been developed and initial flow tests have produced the first hot fluids to the surface.

Project studies, including long term production modelling, have shown that these resources have the potential to support a generating capacity of more than 10,000 megawatts (MW).

The company will now move forward to Stage 2 of the business plan – commercial demonstration – and expects to produce its first MW of geothermal power by the middle of 2009.

Mr Grove-White said “This great news, in conjunction with the impending commissioning of the 1 MW Pilot Plant, will allow the company to move on to building a commercial demonstration plant.”

The 1 MW pilot power station will enable the company to use geothermal energy to power its field operations near Innamincka, including workers’ accommodation, warehouses and workshops.

The company also plans to finalise its preferred design for a 50 MW power plant during 2009. Once operational (planned for 2012), the power plant will produce zero emissions with zero water requirements and will produce enough electricity to power approximately 50,000 households on a continuous basis.

Geodynamics is focused on delivering power to the national electricity grid in 2011, with a targeted production of more than 500 MW by 2016. The company said that eventually output will reach 10,000 MW – the equivalent of 10 to 15 coal-fired power stations – giving hot rocks energy a justifiable claim as a great Australian resource to rank with the Snowy Mountains Scheme. Geodynamics has conducted concept studies to define options for transmitting power from the Cooper Basin to major load centres such as Brisbane, Adelaide or Sydney.

So it’s very positive. About to start up a 1MW plant within a few months, a 50MW plant expected in 2012 and a 500MW plant for 2016.

Long term – 10GW. This is around 25% of Australia’s projected electricity demand in 2050.

We are almost in 2016, so let’s see their progress.

The 2012/2013 report (year ending June 30th, 2013):

The first milestone was the successful completion of the Habanero 4 well and commissioning of the 1 MWe Habanero Pilot Plant in April 2013. Realising this long held goal is a significant achievement and an important demonstration of EGS technology. As one of only three EGS plants operating globally and the first new EGS plant to be commissioned for a significant period of time, there has been a great deal of interest in our results around the world, particularly in the unique reservoir behaviour of the Innamincka granite resource..

So, close to mid-2009, the company was confident of generating 1MW of power “by mid-2009”. 1MW was finally produced in 2013. There are some nice technical descriptions within the report for people who want to take a look:

Innamincka – You should see the nightlife

As for plans going forward in mid-2013:

Our focus for the year ahead is demonstrating the feasibility of a viable small scale commercial plant to supply customers in the Cooper Basin. The first key objectives are the completion of a field development plan for a 5 – 10 MWe commercial scale plant, based on a six well scheme exploiting the high permeability reservoir created at Habanero. The feasibility of supplying process heat as an alternative to supplying power will also be investigated as part of this study.

A year later, the 2013/2014 annual report:

We are Australia’s most advanced geothermal exploration and development company, and a world leader in the emerging field of Enhanced Geothermal Systems (EGS). This year, the Company passed a major milestone with completion of the 1 MWe Habanero Pilot Plant trial near Innamincka, South Australia, one of only three EGS plants operating globally.

Following the successful pilot plant trial, the Company signed an exclusivity agreement with Beach Energy Limited, in regards to our exploration tenements in the Cooper Basin, an important step towards securing a customer for the geothermal resource. Under the agreement, a research program will assess the potential of the Habanero resource to supply heat and/or power to Beach’s potential gas developments in the area.

And now up to date, here is the 2014/2015 annual report (year ending June 30th, 2015):

In line with our search for profitable growth investment opportunities, on 14 July 2015 Geodynamics announced an all scrip offer to acquire Quantum Power Limited. The merger of the two companies will provide Geodynamics shareholders with entry into the biogas energy market, a growing and attractive segment of the clean technology and renewable energy sector, and exposure to immediate short-term attractive project opportunities and a pipeline of medium and longer term growth opportunities.

Geodynamics will continue to actively seek other opportunities to invest in alongside the Quantum investment to build a strong portfolio of opportunities in the clean technology sectors. Having successfully completed the sale and transfer of the Habanero Camp to Beach Energy Limited, additional field works in the Cooper Basin will be undertaken to plug and abandon and complete site remediation works associated with the Habanero-4, Habanero-1, Jolokia and Savina well sites and the surface infrastructure within the Habanero site in line with our permit obligations..

..As reported at 30 June 2014, the Company finalised the technical appraisal of its Cooper Basin project and associated resource. In the absence of a small scale commercial project or other plan to commercialise the project in the medium term, the Company impaired the carrying amount of its deferred exploration, evaluation and development costs in respect of the Cooper basin project to $nil.

[Emphasis added].

Oh.

Who did they sell the camp to?

Beach Energy is an ASX 100 listed oil and gas exploration and production company, with a primary focus on the health and safety of its employees. The company also prioritises a commitment to sustainability and the improvement of social, environmental and economic outcomes for the benefit of all its stakeholders. Beach is focused on Australia’s most prolific onshore oil and gas province, the Cooper Basin, while also having permits in other key basins around Australia and overseas.

Whether or not anyone will be able to produce geothermal energy from this region of Australia is not clear. Drilling over 4km through rock, and generating power from the heat down below is a risky business.

It’s free renewable energy. But there is a cost.

One company, Geodynamics, has put a lot of time and money (from government, private investors and Origin Energy, a large gas and power company) into commercial energy generation from this free energy source and it has not been successful.

Feasibility studies said it could be done. The company was months away from producing their first 1MW of power for 4 years before they succeeded and, following that success, it obviously became clear that the challenges of producing on a commercial scale were too great. At least for Geodynamics.

The only lesson here (apart from the entertainment of deciphering CEO-speak in annual reports) is feasibility doesn’t equate to success.

The dictionary definition seems to be “if something is feasible, then you can do it without too much difficulty”. The reality of “feasibility studies” in practice is quite different, let’s say, “buyer beware”.

Lots of “feasible” projects fail. I had a quick scan through the finances and it looks like they spent over $200M in 6 years, with around $62M from government funding.

We could say “more money is needed”. And it might be correct. Or it might be wrong. Geothermal energy from the Cooper Basin might be just waiting on one big breakthrough, or waiting on 10 other incremental improvements from the oil and gas industry to become economic. It might just be waiting on a big company putting $1BN into the exercise, or it might be a project that people are still talking about in 2030.

Individuals, entrepreneurs and established companies taking risks and trying new ideas is what moves the world forward. I’m sure Geodynamics has moved the technology of geothermal energy forward. Companies like that should be encouraged. But beware press releases and feasibility studies.

Articles in this Series

Renewable Energy I – Introduction

Renewables II – Solar and Free Lunches – Solar power

Renewables III – US Grid Operators’ Opinions – The grid operators’ concerns

Renewables IV – Wind, Forecast Horizon & Backups – Some more detail about wind power – what do we do when the wind goes on vacation

Renewables V – Grid Stability As Wind Power Penetration Increases

Renewables VI – Report says.. 100% Renewables by 2030 or 2050

Renewables VII – Feasibility and Reality – Geothermal example

Renewables VIII – Transmission Costs And Outsourcing Renewable Generation

Renewables IX – Onshore Wind Costs

Renewables X – Nationalism vs Inter-Nationalism

Renewables XI – Cost of Gas Plants vs Wind Farms

Renewables XII – Windpower as Baseload and SuperGrids

Renewables XIII – One of Wind’s Hidden Costs

Renewables XIV – Minimized Cost of 99.9% Renewable Study

Renewables XV – Offshore Wind Costs

Renewables XVI – JP Morgan advises

Renewables XVII – Demand Management 1

Renewables XVIII – Demand Management & Levelized Cost

Renewables XIX – Behind the Executive Summary and Reality vs Dreams

Renewable Energy I

July 30, 2015 by scienceofdoom

This blog is about climate science.

I wanted to take a look at Renewable Energy because it’s interesting and related to climate science in an obvious way. Information from media sources confirms my belief that 99% of what is produced by the media is rehashed press releases from various organizations with very little fact checking. (Just a note for citizens alarmed by this statement – they are still the “go to source” for the weather, footage of disasters and partly-made-up stories about celebrities).

Regular readers of this blog know that the articles and discussion so far have only been about the science – what can be proven, what evidence exists, and so on. Questions about motives, about “things people might have done”, and so on, are not of interest in the climate discussion (not for this blog). There are much better blogs for that – with much larger readerships.

Here’s an extract from About this Blog:

The same principles will apply for this discussion about renewables. Our focus will be on technical and commercial aspects of renewable energy, with a focus on evidence rather than figuring it out from “motive attribution”. And wishful thinking – wonderful though it is for reducing personal stress – will be challenged.

As always, the moderator reserves the right to remove comments that don’t meet these painful requirements.

Here’s a claim about renewables from a recent media article:

I couldn’t find any evidence in the article that verified the claim. Only that it came from Bloomberg New Energy Finance and was the opposite of a radio shock jock. Generally I favor my dogs’ opinions over opinionated media people (unless it is about the necessity of an infinite supply of Schmackos starting now, right now). But I have a skeptical mindset and not knowing the wonderful people at Bloomberg I have no idea whether their claim is rock-solid accurate data, or “wishful thinking to promote their products so they can make lots of money and retire early”.

Calculating the cost of anything like this is difficult. What is the basis of the cost calculation? I don’t know if the claim in BNEF’s calculation is “accurate” – but without context it is not such a useful number. The fact that BNEF might have some vested interest in a favorable comparison over coal and gas is just something I assume.

But, like with climate science, instead of discussing motives and political stances, we will just try and figure out how the numbers stack up. We won’t be pitting coal companies (=devils or angels depending on your political beliefs) against wind turbine producers (=devils or angels depending on your political beliefs) or against green activists (=devils or angels depending on your political beliefs).

Instead we will look for data – a crazy idea and I completely understand how very unpopular it is. Luckily, I’m sure I can help people struggling with the idea to find better websites on which to comment.

Calculating the Cost

I’ve read the details of a few business plans and I’m sure that most other business plans also have the same issue – change a few parameters (=”assumptions”, often “reasonable assumptions”) and the outlook goes from amazing riches to destitution and bankruptcy.

The cost per MWHr of wind energy will depend on a few factors:

And of course, in any discussion about “the future”, favorable assumptions can be made about “the next generation”. Is the calculation of $74/MWHr based on what was shipped 5 years ago and its actuals, or what is suggested for a turbine purchased next year?

If you want wind to look better than gas or coal – or the converse – there are enough variables to get the result you want. I’ll be amazed if you can’t change the relative costs by a factor of 5 by playing around with what appear to be reasonable assumptions.

Perhaps the data is easy to obtain. I’m sure many readers have some or all of this data to hand.

Moore’s Law and Other Industries

Most people are familiar with the now legendary statement from the 1960s about semiconductor performance doubling every 18 months. This revolution is amazing. But it’s unusual.

There are a lot of economies of scale from mass production in a factory. But mostly limiting cases are reached pretty quickly, after which cost reductions of a few percent a year are great results – rather than producing the same product for 1% of what it cost just 10 years before. Semiconductors are the exception.

When a product is made from steel alloys, carbon fiber composites or similar materials we can’t expect Moore’s law to kick in. On the other hand, products that rely on a combination of software, electronic components and “traditional materials” and have been produced on small scales up until now can expect major cost reductions from amortizing costs (software, custom chips, tooling, etc) and general economies of scale (purchasing power, standardizing processes, etc).

In some industries, rapid growth actually causes cost increases. If you want an experienced team to provide project management, installation and commissioning services you might find that the boom in renewables is driving those costs up, not down.

A friend of mine working for a natural gas producer in Queensland, Australia recounted the story of the cost of building a dam a few years ago. Long story short, the internal estimates ranged from $2M to $7M, but when the tenders came in from general contractors the prices were $10M to $25M. The reason was a combination of:

The point being that industry insiders – i.e., the customer – with a strong vested interest in understanding current costs was out by a factor of more than three in a traditional enterprise. This kind of inaccuracy is unusual but it can happen when the industry landscape is changing quickly.

Even if you have signed a fixed price contract with an EPC you can only be sure this is the minimum you will be paying.

The only point I’m making is that a lot of costs are unknown even by experienced people in the field. Companies like BNEF might make some assumptions but it’s a low stress exercise when someone else will be paying the actual bills.

Intermittency & Grid Operators

We will discuss this further in future articles. This is a key issue between renewables and fossil fuel / nuclear power stations. The traditional power stations can create energy when it is needed. Wind and solar – mainstays of the renewable revolution – create energy when the sun shines and the wind blows.

As a starting point for any discussion let’s assume that storing energy is massively uneconomic. While new developments might be available “around the corner”, storing energy is very expensive. The only real mechanism is pumped hydro schemes. Of course, we can discuss this.

Grid operators have a challenge – balance demand with supply (because storage capacity is virtually zero). Demand is variable and although there is some predictability, there are unexpected changes even in the short term.

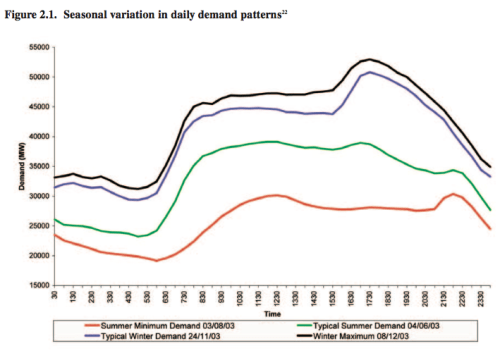

The demand curve depends on the country. For example, the UK has peak demand in the winter evenings. Wealthy hotter countries have peak demand in the summer in the middle of the day (air-conditioning).

There are two important principles:

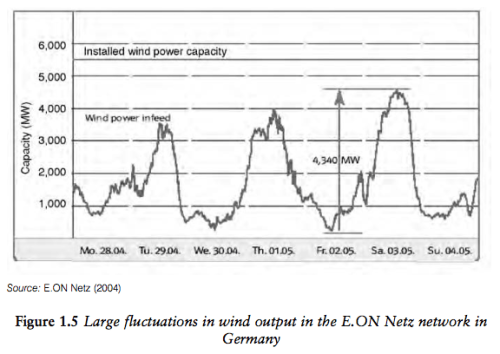

The first is a simple one. An example is the Sizewell B nuclear power station in the UK supplying about 1GW [fixed] out of 80GW of total grid supply. From time to time it shuts down and the grid operator gets very little notice. So grid operators already have to deal with this. They use statistical calculations to ensure excess supply during normal operation, based on an acceptable “loss of load probability”. Total electricity demand is variable and supply is continually adjusted to match that demand. Of course, the scale of intermittency from large penetration of renewables may present challenges that are difficult to deal with by comparison with current intermittency.

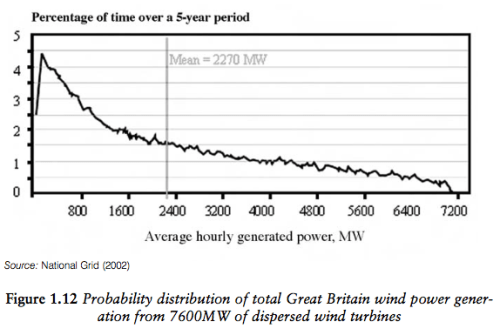

The second is the difficult one. Here’s an example from a textbook by Godfrey, that’s actually a collection of articles on (mainly) UK renewables:

The essence of the calculation is a probabilistic one. At small penetration levels, the energy input from wind power displaces the need for energy generation from traditional sources. But as the percentage of wind power increases, the “potential down time” causes more problems – requiring more backup generation on standby. In the calculations above, wind going from 0.5 GW to 25 GW only saves 4 GW in conventional “capacity”. This is the meaning of capacity credit – adding 25 GW of wind power (under this simulation) provides a capacity credit of only 4 GW. So you can’t remove 25 GW of conventional from the grid, you can only remove 4 GW of conventional power.

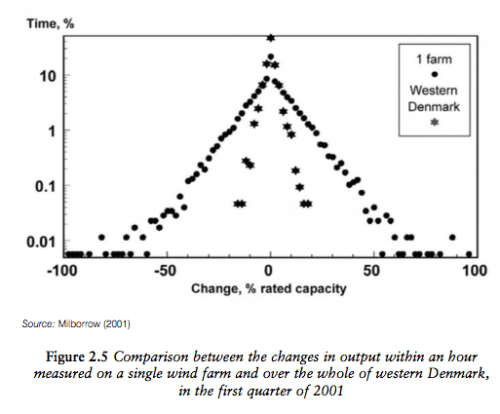

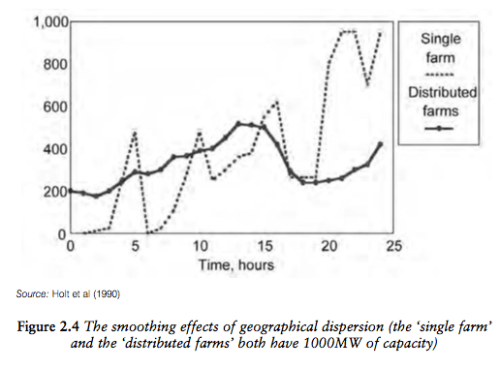

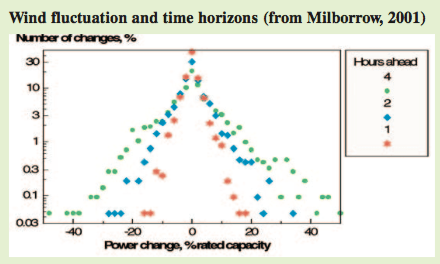

Now the calculation of capacity credit depends on the specifics of the history of wind speeds in the region. Increasing the geographical spread of wind power generation produces better results, dependent on the lower correlation of wind speeds across larger regions. Different countries get different results.

So there’s an additional cost with wind power that someone has to pay for – which increases along with the penetration of wind power. In the immediate future this might not be a problem because perhaps the capacity already exists and is just being put on standby. However, at some stage these older plants will be at end of life and conventional plants will need to be built to provide backup.

Many calculations exist of the estimated $/MWh from providing such a backup. We will dig into those in future articles. My initial impression is that there are a lot of unknowns in the real cost of backup supply because for much potential backup supply the lifetime / maintenance impact of frequent start-stops is unclear. A lot of this is thermal shock issues – each thermal cycle costs $X.. (based on the design of the plant to handle so many thousand starts before a major overhaul is needed).

The Other Side of the Equation – Conventional Power

It will also be interesting to get some data around conventional power. Right now, the cost of displacing conventional power is new investment in renewables, but keeping conventional power is not free. Every existing station has a life and will one day need to be replaced (or demand will need to be reduced). It might be a deferred cost but it will still be a cost.

$ and GHG emissions

There is a cost to adding 1GW of wind power. There is a cost to adding 1GW of solar power. There is also a GHG cost – that is, building a solar panel or a wind turbine is not energy free and must be producing GHGs in the process. It would be interesting to get some data on this also.

Conclusion– IntroductionI wrote this article because finding real data is demanding and many websites focused on the topic are advocacy-based with minimal data. Their starting point is often the insane folly and/or mendacious intent of “the other side”. The approach we will take here is to gather and analyze data.. As if the future of the world was not at stake. As if it was not a headlong rush into lunacy to try and generate most energy from renewables.. As if it was not an unbelievable sin to continue to create electricity from fossil fuels..

This approach might allow us to form conclusions from the data rather than the reverse.

Let’s see how this approach goes.

I am hoping many current (and future) readers can contribute to the discussion – with data, uncertainties, clarifications.

I’m not expecting to be able to produce “a number” for windpower or solar power. I’m hopeful that with some research, analysis and critical questions we might be able to summarize some believable range of values for the different elements of building a renewable energy supply, and also quantify the uncertainties.

Most of what I will write in future articles I don’t yet know. Perhaps someone already has a website where this project is already complete and in my Part Two will just point readers there..

Articles in this Series

Renewable Energy I – Introduction

Renewables II – Solar and Free Lunches – Solar power

Renewables III – US Grid Operators’ Opinions – The grid operators’ concerns

Renewables IV – Wind, Forecast Horizon & Backups – Some more detail about wind power – what do we do when the wind goes on vacation

Renewables V – Grid Stability As Wind Power Penetration Increases

Renewables VI – Report says.. 100% Renewables by 2030 or 2050

Renewables VII – Feasibility and Reality – Geothermal example

Renewables VIII – Transmission Costs And Outsourcing Renewable Generation

Renewables IX – Onshore Wind Costs

Renewables X – Nationalism vs Inter-Nationalism

Renewables XI – Cost of Gas Plants vs Wind Farms

Renewables XII – Windpower as Baseload and SuperGrids

Renewables XIII – One of Wind’s Hidden Costs

Renewables XIV – Minimized Cost of 99.9% Renewable Study

Renewables XV – Offshore Wind Costs

Renewables XVI – JP Morgan advises

Renewables XVII – Demand Management 1

Renewables XVIII – Demand Management & Levelized Cost

Renewables XIX – Behind the Executive Summary and Reality vs Dreams

References

Renewable Electricity and the Grid : The Challenge of Variability, Godfrey Boyle, Earthscan (2007)

Posted in Commentary, Renewables | 122 Comments »